Startups

PrimeInvestor is an unbiased, independent, personal finance research platform. We empower retail investors with simple, meaningful and actionable investment i insights, recommendations, and solutions so people can confidently build wealth for any need. Our main offerings include researched recommendations on mutual funds, stocks, deposits, ETFs, and insurance. We are a subscription service with regular updates of content as well as research and recommendations

Type: StartUp

Industry: Financial Research

Team Size: 9 people

CEO: Mr. N.Venkatraman

Chennai

www.lampfinmart.com

lightalamp2019@gmail.com

Lein Asset Management, Non performing assets Sale data through interactive portal with a yearly subscription.

Type: StartUp

Industry: Financial Research

Team Size: 9 people

CEO: Mr. Sathish Kumar M

Chennai

https://transactnow.co.in

sathish.kumar@transactnow.co.in

Transact Nexus Tech Pvt Ltd is a new age Fintech organization to cater to unbanked, underserved, migrant and rural population in India. It operates under the brand name of Transactnow. We believe access to financial services is not a luxury, It’s a necessity and we empower the last mile customer with the financial digital services powered by cash. In a simple statement we can say that we are creating a next-door banking solution through nearby retail stores through B2B2C model through our widespread network of distributors and retailers across India. We offer products like Aadhaar Enabled payment services, Domestic Money remittance, Recharges, Utility Bill Payments, Bus/Train/Flight/Hotel bookings, Cash In & Cash Out Services, Micro ATM’s, Assisted E-commerce, Farmer Loan Eco System, GST Ready CRM Based Super POS and finally aiming to become a reputed brand in Neo Banking. Transactnow has now been selected to be part of the Govt of India’s first Fin Tech Incubation Initiative – Fin Blue.

Type: StartUp

Industry: Financial Research

Team Size: 10 people

CEO: Mr. Satish Vijayan

Chennai

https://nexdha.com

satish@nexdha.com

Nexdha provides short–term credit at the speed of the internet. Our first product, (CC2CASA allows you to pay from your credit card into any bank account. We are in the process of tying up with NBFCs to provide other related credit products

Type: StartUp

Industry: Financial Research

Team Size: 10 people

CEO: Mr. Amit Deshmukh

Nashik

https://loan4fauji.com

support@loan4fauji.com

It is India’s First & only online marketplace of financial products & services exclusively catering services to Military, Paramilitary & Ex-servicemen.

Type: StartUp

Industry: Financial Research

Team Size: 14 people

CEO: Mr. Arun Rajeev Sankaran

Kanyakumari

rajeev@finos.in

Fintech B2B SaaS Digitalizing Financial Institutions especially Microfinance & Credit Cooperatives to operate like modern digital banks.

Type: StartUp

Industry: Financial Research

Team Size: 14 people

CEO: Mr. Mahendra Panchal

Bhopal

mahendra@bimaxpress.com

https://bimaexpress.com

We are committed to improving the overall HealthCare ExperienceThe first problem statement which we are solving for Hospitals is the Claims Experience and the Cashflow requirements associated with it. Apart from that we are in process of developing a Buy Now Pay Later proposition for the people in need of HealthCare.

Type: StartUp

Industry: Fintech

Team Size: 07 people

CEO: Mr. Partho Chakraborty

Bengaluru

http://www.annona.in/tasthana.html

partho@annona.in

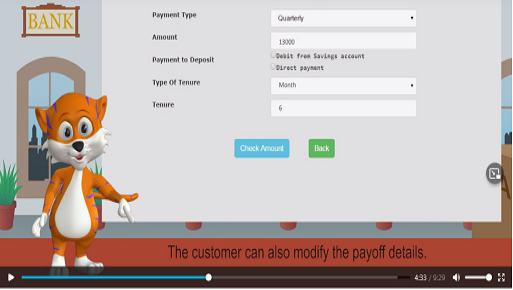

Tasthana, deposit management solution, helps banks get more deposits of a bare minimum of ₹ 1,000 Crores per annum, if not more which is over and above the existing deposits.

Type: StartUp

Industry: Fintech

Team Size: 25 people

CEO: Mr. Uthayashankar

Chennai

partners@finaara.com

Fortax is a digital transparent solution for the MSME’s which empowers to file and verify their business compliance-GST & Tax related data in Simplest, Unique and Hassle free. The Solution also builds Financial Strength of Micro Entrepreneurs to make them eligible for Loans from the Formal Sector of lending

CampusDunia is tech enabled innovative Web and Mobile Aggregator Platform which offers Instant Study Loan to Applicants through its Multiple NBFC’s by the Use of AI & ML

Monkeycap is an online insurance platform to compare and buy retail insurance policies like Car, Bike, Health, etc. Licensed by IRDAI in 2017 as an Insurance Broker in the name of Arka Insurance Broking P Ltd., we also handle corporate insurances including Property, Engineering, Marine, Liability lines and employee benefits through customized risk advisory and dedicated claims support services.

Type: StartUp

Industry: Fintech

Team Size: 3 people

CEO: Mr.Santosh

Chennaisanthoshvkumar@whileofone.com

KapiitalKapslock provides the fintech solution for the Financial Institution offering various set of products and solutions, Our product SquareNow is a complete technology set Which provide End to End solution for Financial Institution,SquareNow was born out of the year’s association with many of the NBFC’S, understand their business operations from the ground level till management level to provide the excellent business solutions.

A global, aggregation platform of leading regulated payment providers for execution of cross border payments enabling Banks & NBFCs deliver services in 200+ countries & 130+ currencies, have better Fx spreads, Directly integrate with ERP/ TMS systems of enterprises for all the Fx payments in real-time.

Cardsto Private Limited is backed by the State Government of Himachal Pradesh, IIT Mandi and Finblue (STPI). Cardsto Intend to Build a Neo Banking-CUM-Fintech platform for the young adults of India to Give them Simplest and Best banking as well as fintech experience . So that people can Manage , Save and Track their money in a smarter way.

Type: StartUp

Industry: Fintech

Team Size: 150 people

CEO: Mr.Jaideep Pawar

Mumbai

jaideep.pawar77@gmail.com

Building Digital payments acceptance infrastructure for Tier 3 to Tier 6 locations in India. Focus is on Cooperative Banks , MFI’s & Financial Institutions wanting to scale its network to Rural Market.

Type: StartUp

Industry: Fintech

Team Size: 200 people

CEO: Mr.Ganga Ram Gupta

Lucknow

gangagupta@financekaart.com

Next generation neutral marketplace Bank for instant customized rate quotes on loans/credit cards & other financial products & provides credit access, choice & control to MSMEs and Farmers who are under-served / un-served from the formal sector and work as a financial match- making platform with unique algorithm along with alternative credit score

Type: StartUp

Industry: Fintech

Team Size: 3 people

CEO: Mr.Yashraj Singh

Muzzafarpur

singh.116@iitj.ac.in

Finplex is an online learning and developing knowledge and prudence for users for investing in the stock markets where users can learn and earn at the same time. It is a learning platform with competitive spirit and has an aim connecting people to financial literacy and inclusion by way of learning by doing.

Type: StartUp

Industry: Fintech

Team Size: 5 people

CEO: Mr.Neha Misra

Lucknow

neha@thefinlitproject.com

The app provides comprehensive micro courses on personal finance and fintech with in app quizzes and an option to book individual consultation and mentoring sessions. We aspire to elevate financial literacy beyond opening bank accounts highlighting emerging avenue like DeFi, Financial Literacy powered investments, Sustainable Finance, Islamic Finance, Wealth Inequality, Savings, Quant Funds and more

Type: StartUp

Industry: Fintech

Team Size: 5 people

CEO: Mr.Vinaya Sathyanarayana

Bengaluru

vinaya@kutumba.one

Type: StartUp

Industry: Fintech

Team Size: 5 people

CEO: Mr.Anand

Pune

anandpokharna@akfinserv.co.in

http://www.inveck.com/

Inveck is a cloud-based tool& mobile application that aims to make physical verification process digitally active, transparent and effective. It replaces the traditional approach of carrying a pen, paper, calculator or laptop on field for counting stock/asset lying in warehouses, factories & stores.